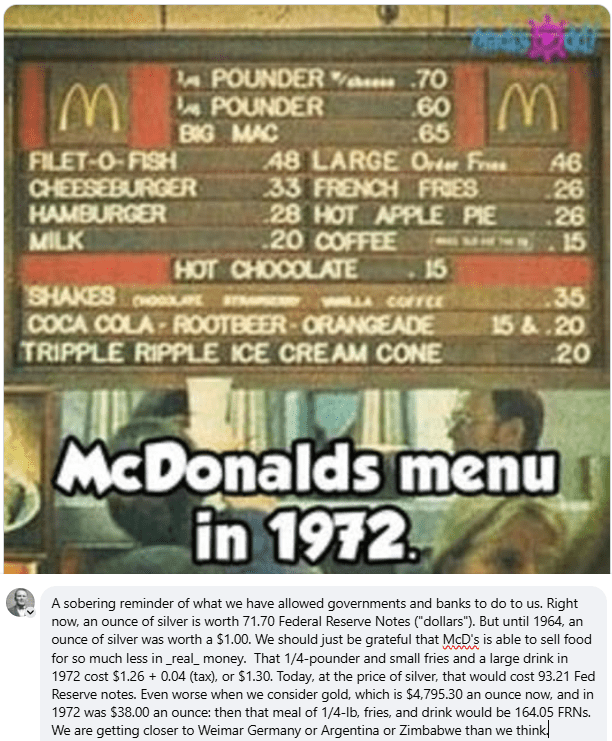

The high prices that gold, silver and platinum are bringing show the devaluation of the American dollar – but in terms of things that we do not deal with every day. This MacDonald’s menu, from 1972, makes it fairly easy to see the effects of inflation:

Inflation, in our time, is caused by printing more money. (In the early days of South American colonization, Spain actually had so much silver being shipped in from South America that it damaged their economy – but that is a different story). Neither major political party holds the moral high ground on inflation – both run the printing presses. I will admit, that, under the Carter and Biden presidencies, they tended to run 24/7 – but neither party has thought it worthwhile to flat stop the presses.

Paul Totten showed me the first hundred dollar bill I ever saw, in old Rexford in 1957. It was quite a while before I saw the next one. Back then, forty acres in Trego sold for around $30 per acre – gold was $35.25. On the gold scale, we would be looking at about 160,000 for 40 acres now – it looks like gold may have lagged a bit over land. It isn’t that the land, gold and silver is worth so much more – there are just more greenbacks available. When Paul Totten showed a hundred dollar bill to that little boy, hundred dollar bills were rare. Now they are common. In 1957, the US population was a bit over 171 million. In 2025, the estimate is twice that. Population increase does correspond with scarcity – but can’t explain all of the lost value.

In my youth, I worked with an old soil scientist – Jack Cloninger – who told of a cost of living decrease that occurred back in the fifties. Searching the net, I found that it was -.74%. Less than a single percentage point, and over eighty years ago. Jack still remembered it 25 years later. Probably done by accident, yet proof that a financial policy dedicated to keeping that printed dollar strong can succeed. The fact that the American dollar is so much weakened shows that neither party has attempted to keep it strong. Keynesian Economics, as applied by politicians, demonstrates the power of wanting to believe in something that is obviously false. How nice it would be to live in a situation where you could spend yourself rich!

I think that we could turn inflation around by pausing the presses. It would probably take a long pause. Living within our national budget would strengthen the dollar. While the cost of living would go down _ as would the Dow-Jones – it would just be a numbering change. In 1957, I could buy a candy bar for a nickel. This year they have quit coining pennies. I remember Katie’s comment in the late eighties – “They still have penny candy – it just cost’s a nickel.” Trump’s economic policies are definitely better than Biden’s. But that’s like claiming you’re more attractive than a wart hog. The crashing dollar is due to voting in the economically illiterate for most of a century. Leadership from the least competent is probably always a bad idea – even if they are the nicest people, or the candidates who most badly want the position.

Leave a comment